Member Update April 2022

April Member update information

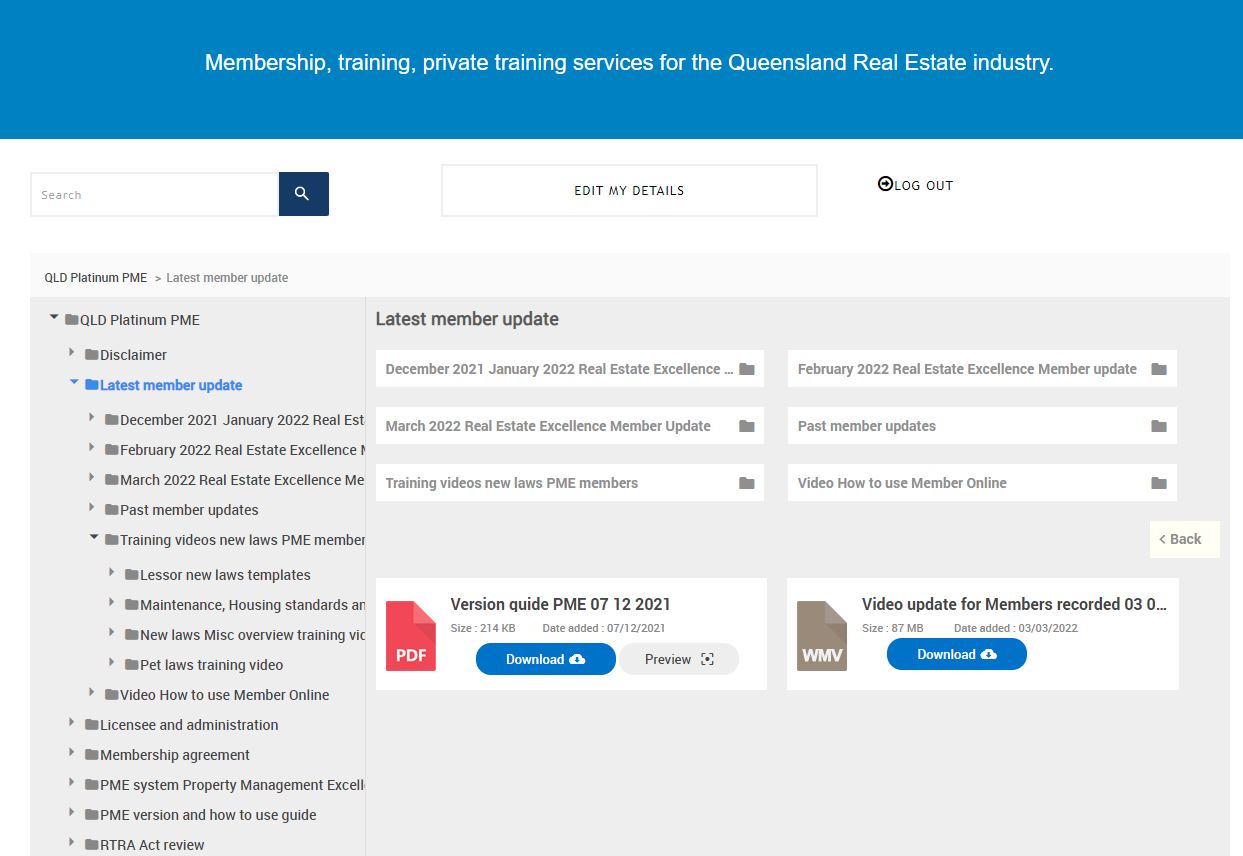

There are NEW training videos on the NEW tenancy laws commencing 1st October 2022 to view anytime. Go to www.realestateexcellence.com.au/memberonline, login with your office login details. Then go to Latest member update folder as shown below. There you will see latest and past updates, and a folder called Training videos new laws. TEMPLATES in word version to give to lessors is also available in the Latest Member update folder.

Videos ready now to view are as follows.

Pet laws

New laws miscellaneous

Tenant new notice of intention to leave

Minimum housing standards

with more to come.

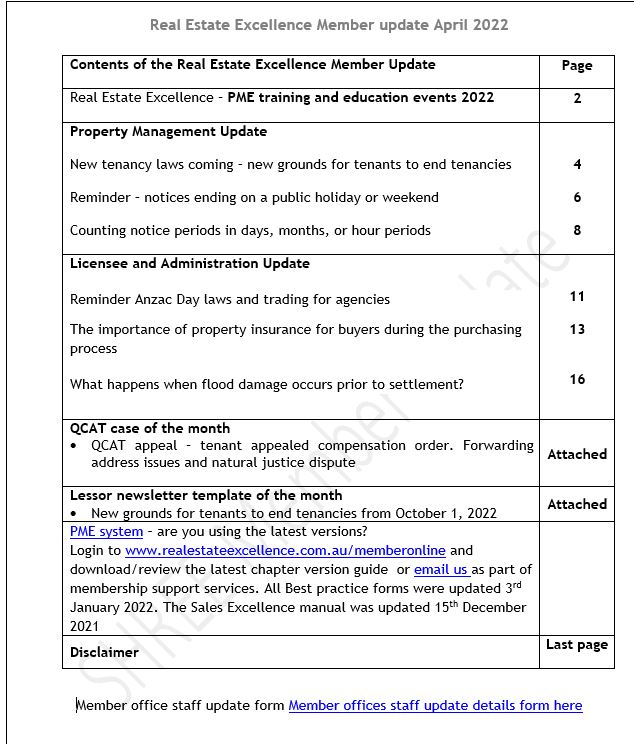

April Member update

The April 2022 Real Estate Excellence Member Update is at Member login (realestateexcellence.com.au) (latest member update folder) as at 29th March, and will be emailed to Members on the 6th April 2022. The contents are below. Listen to short podcast here.