April/May 2023 Industry Update

Have your say - tenancy law reforms Stage - Consultation closes 5pm 29th May 2023 Visit Stage 2 rental law reform |

If a tenancy agreement is signed prior to 1 July 2023 but commences after 1 July 2023 and contains a ‘rent increase’ (but it has been less than 12 months since the tenancy started with the rental amount or the rent was increased), then the rent increase will not apply. This is regardless of what date the agreement was signed by the tenant and owner/property manager.

We understand that in some situations, it may be business practice to have renewal agreements signed early, however if owners/property managers have renewals of this nature that will not be compliant, they should enter into a new tenancy agreement which corrects the rental amount to the amount payable under the current agreement. This newly signed tenancy agreement will then replace the existing agreement, regardless of whether the term is the same or not, providing the start date remains the same.

In the unlikely situation where a tenant refuses to negotiate and/or sign a new tenancy agreement, the owner/property manager must not enforce the higher rent amount. The owner/property manager should confirm in writing to the tenant that the previous rental amount will apply. Please note, the RTA cannot provide legal advice on individual cases and owners/property managers/managing agents should seek their own independent legal advice".

Members of Real Estate Excellence,Membership services, benefits and options (realestateexcellence.com.au) please email us if we can assist any further. Non- Members, please contact your preferred advisor, or the RTA.

"From 1 July 2023, changes to limit rent increase frequency to once every 12 months will come into effect for all new and existing tenancies.

Any rent increase after 1 July 2023 will only be valid if it has been at least 12 months since the previous rent increase. More frequent rent increases written into tenancy agreements prior to 1 July 2023 will not apply.

The rent increase frequency changes apply for the duration of the tenancy if at least one tenant or resident is the same when the agreement is renewed.

Once these changes come into effect, it will be an offense under the Residential and Rooming Accommodation Act 2008 (the Act) to increase the rent more frequently than once every 12 months".

Rent increases which meet current requirements and come into effect before 1 July 2023 will still apply.

From 1 July 2023, the rent increase frequency changes will apply to all new and existing tenancies. Any rent increase will only be valid if it has been 12 months or more since the last increase. More frequent rent increases written into tenancy agreements will not apply after this date.

Example 1: Tenants moved into a rental property in December 2022 and signed a 12-month agreement, which included a clause to increase the rent in June 2023. This rent increase still applies because it comes into effect before the 1 July 2023 changes.

Example 2: Tenants moved into a rental property in February 2023 and signed a 12-month agreement, which included a clause to increase the rent in August 2023. This rent increase is invalid because it comes into effect after 1 July 2023 and it has been less than 12 months since the last rent increase. The rent cannot be increased until February 2024.

Example 3: Tenants moved into a rental property in February 2023 and signed a 24-month agreement, which included a clause to increase the rent in February 2024. The February 2024 rent increase will still apply, because it will be 12 months since the last rent increase

Emailed 17th May 2023 to Mailing List.

Rent increase frequency changes for Queensland July 1, 2023. View short video here.

8th May 2023 - New disclosure requirements for property sellers in Queensland

1. New statutory seller disclosure requirements

The Queensland Government is moving closer to the introduction of a seller disclosure regime for the sale of land in Queensland. The new laws, once passed, will result in a change in direction from a 'buyer beware’ approach to a proactive seller disclosure approach, which is in place in some other states.

The Property Law Bill 2023 (Qld) was introduced into the Queensland Parliament on 23 February 2023 to replace the Property Law Act 1974 (Qld). A public consultation process followed and a report from the Legal Affairs and Safety Committee was tabled to Parliament on 14 April 2023.

The Property Law Bill 2023 (Qld) will not become law in Queensland until the bill is further progressed through Parliament (and amendments may be made). The commencement date of the Act is not yet known.

Once enacted and commenced, it will introduce a suite of new disclosure requirements for sales of registered (established) land in Queensland.

These new requirements will apply to sellers of not only residential property but also agricultural, commercial, industrial and other freehold property. They apply to the sale of all registered freehold property including sales by auction, sales by a mortgagee or receiver, and sales arising from the exercise of an option, although there are some exceptions (referred to below).

Before a contract of sale for a property is signed by the buyer, the seller will be required to give the following disclosure documents to the buyer (either physically or electronically):

- a ‘disclosure statement’ in the approved form for the property, disclosing information prescribed by regulation; and

- each document prescribed by regulation (each a ‘prescribed certificate’) applicable to the property.

The approved form requires certain warnings and other statements to be included as part of the disclosure statement (as set out in the regulation).

The relevant regulation is the proposed Property Law Regulation 2023 (Qld).

The disclosure statement must be completed with information that is true at the time the statement is given to the buyer and be signed by the seller or an authorised agent.

2. Disclosure statement

Sellers will be required to disclose the following information (among other things) in a disclosure statement:

- the details of each unregistered encumbrance affecting the property;

- the zoning of the property under the local government’s planning scheme;

- information relating to contamination and environmental protection in respect of the property under the Environmental Protection Act 1994 (Qld) (including, among other things, whether the property is recorded on the environmental management register or the contaminated land register and whether the seller is required to give a notice under section 408 of that Act);

- whether the property is affected by an application or order in relation to a tree under the Neighbourhood Disputes (Dividing Fences and Trees) Act 2011 (Qld);

- whether the property is affected by a transport infrastructure proposal that will alter the dimensions of the property;

- whether the property is heritage listed;

- whether a government body has notified an intention to resume the property or part of it;

- whether there is a pool on the property (or common property);

- whether there is a commercial office building of more than 1,000m2 on the property; and

- information relating to the amount of rates and water charges payable for the property.

The disclosure statement does not require disclosure of the following – flooding information, structural defects or pest infestation, current or historical use, details of past or current building approvals for the property, planning law limits on the use of the property and services connected or not connected to the property.

A link to the draft disclosure statement can be found here (note that the draft statement was made available for public comment in June 2022 and is subject to change).

From the draft disclosure statement, you will see that the disclosure statement will contain certain statutory warranties given by the seller.

3. Prescribed documents

Under the proposed Property Law Regulation 2023 (Qld), the prescribed documents are copies of the following:

- a title search showing registered interests for the property;

- the registered plan of survey for the property;

- notices in relation to certain matters under the Queensland Building and Construction Commission Act 1991(Qld) (unlicensed building work), the Building Act 1975 (Qld) (show cause and enforcement notices) and the Planning Act 2016 (Qld) (show cause and enforcement notices) (if applicable);

- any document given to the seller in relation to information mentioned in paragraphs 2(e),(f) and (g) above;

- for any pool, a pool compliance certificate or a notice of no pool safety certificate;

- the community management statement for the scheme (CMS) (if applicable);

- a body corporate certificate (containing information about the body corporate and the scheme) or, if one cannot be provided, the reasons why the seller has not been able to obtain the certificate (if applicable); and

- for schemes established under the Building Units and Group Titles Act 1980 (Qld), copies of by-laws and exclusive use allocations that are still in effect but not included in the CMS (if applicable).

Links to the draft body corporate certificates can be found here for the sale of a lot included in a community titles scheme and for the sale of a lot regulated under the Building Units and Group Titles Act 1980 (note that the draft certificates were made available for public comment in June 2022 and are subject to change).

4. Failure to comply with the new disclosure requirements

The buyer may terminate the contract of sale any time before settlement by written notice to the seller if:

- the seller has not given the buyer a disclosure statement or any applicable prescribed certificate before the contract was signed by the buyer; or

- the disclosure statement or any applicable prescribed certificate was given to the buyer and all of the following apply:

(1) it is inaccurate or incomplete in relation to a material matter affecting the property at the time it was given to the buyer;

(2) at the time the contract is signed by the buyer, the buyer is not aware of the correct state of affairs concerning the matter; and

(3) if the buyer had been aware of the correct state of affairs concerning the matter, the buyer would not have signed the contract.

A ‘material matter’ does not include a matter prescribed by regulation not to be a material matter. Currently, under the proposed Property Law Regulation 2023 (Qld) each matter in paragraphs 2(h) and (i) above are not a material matter.

Any amount paid by the buyer for the property under the contract (including the deposit) must be repaid by the seller together with any interest earned on the investment of that amount within 14 days after any termination.

5. Exceptions to the new disclosure requirements

A buyer may waive its right to receive the disclosure documents by written notice prior to the buyer signing the contract, but only in circumstances where:

- the seller and buyer under the relevant contract are ‘related’ (e.g., a family relative or a related body corporate); or

- the contract price for the property is more than $10 million including GST (or an amount to be prescribed under regulation).

A seller need not comply with its disclosure obligations if the buyer under the contract is the Commonwealth, any state, any local government, any statutory body, any listed corporation or any subsidiary of any listed corporation.

There are other circumstances under which the new disclosure requirements do not apply (e.g., sale of interest to co-owner, boundary adjustment between adjoining owners, contract gives effect to a court order, enforcement warrant, financial agreement under the Family Law Act 1975 (Cth) or transmission to a personal representative because of the death of an owner).

As the disclosure obligations only apply in relation to freehold properties, sellers under contracts in respect of leases (e.g., state leasehold land and ‘company title’ arrangements) would not be subject to the disclosure requirements.

Application to option agreements

The disclosure obligations are applicable to options (call options, put options and put and call options).

However, if:

- the grantee of the call option (or the grantor of the put option) is the same person as the buyer under the resulting contract of sale; and

- the seller has already complied with its disclosure obligations prior to the buyer signing the option agreement,

then the seller is not required to comply with its disclosure obligations again when the contract is entered into pursuant to the exercise of that option.

This means that if the call option is exercised in favour of a nominee (who will become the buyer of the property), then the seller as grantor must comply with the disclosure requirements again in relation to that resultant contract, even if the grantee under the option agreement has already received the disclosure documents.

If you require any assistance navigating the proposed disclosure requirements or other assistance with a property transaction, please contact HopgoodGanim's Property team.

5th May 2023

23rd April 2023 - July 1 new tenancy law changes

A detailed best practice guide on all the new and amended laws from July 1 will be uploaded to Member login - latest member updates folder - April 2023, and emailed to Members on Monday 24th April 2023. The best practice guide for Members covers the rent increase time limit laws, breach of agreement ending agreement early (break lease) and change of shared tenancy scenarios. The amendment to section 277 ending of tenancies provision is also included, and more, including a lessor template in word version to send to clients.

21st April - An important video for all Property Managers

View here. Update EDIT 4.25pm The elusive Bill has been found! Thank you to a member who has sent this link - view the amendments passed to commence July 1 here.

20th April 2023 - Stage 2 tenancy law reforms consultation

Property Managers/Agents are encouraged to have their say on stage 2 tenancy law reforms. Real Estate Excellence strongly recommends all to share the information with property owners to ensure they are aware, and encouraged to complete the Government survey, and or write a submission. The laws affect property owners (and tenant); as agent we manage our clients law. Below are the Government priority areas.

For more information, click here. Members of Real Estate Excellence, also refer to the email sent to you yesterday afternoon regarding the rent increase law changes via the Member update service. A New (amended) RTA Form 18a looks likely to be released on July 1, 2023, due to the rent increase law changes as amendments were also made by Parliament on Tuesday night to the regulations of the RTRA Act (where the Form 18a comes from).

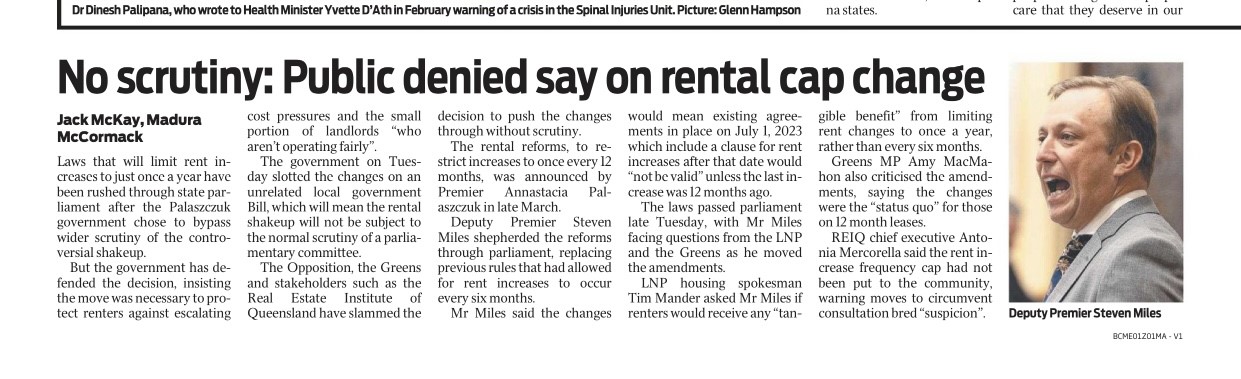

19th April 2023 - The Courier Mail Page 4

An explanation from the Government as to why there was no consultation regarding the rent increase law changes, and why they occurred without notice at speed. Sourced from the Explanatory notes.

18th April 2023 - Rent increase law changes

Members of Real Estate Excellence, more will come soon via the Member update email service.

|

||

|

||

|

18th April 2023 - Stage 2 Queensland rental reforms

One of the focuses of the Queensland Government in the Stage 2 rental reforms is on the tenancy application process.

A news article today highlights some of the concerns, with the options paper for Stage 2 outlining other matters and options. Read news article here.

A quote from the options paper is below

Balancing privacy and access

Queensland’s rental laws should strike an appropriate balance between the renters’ right to privacy and quiet enjoyment and rental property owners’ entry rights and need for appropriate, relevant information to assist them to make decisions about their investment.

Stage 2 rental law reform will explore options to:

- provide renters with sufficient privacy and quiet enjoyment and rental property owners with the access to information they need to inform investment decision making

- ensure information provided by prospective renters is relevant to assessing their suitability and is appropriately used and handled."

|

18th April 2023 - Stage 2 Rental Law reforms information released - Stage 2 Queensland tenancy law reforms announced.Listen to short podcast here.

|

||

|

||

|

Sourced from The Courier Mail 18th April 2023

14th April 2023 - Sourced article Cordato Partners

What is the Reserve Bank telling us about the time to buy residential property?

There’s a flood of conflicting opinions on rent increases and price falls in the residential property market.

But opinions are just opinions.

Facts are best. Especially facts from the Reserve Bank of Australia, published in a Bulletin published in March 2023 and comments made by Reserve Bank Governor Philip Lowe in an address on 5 April 2023.

- The RBA Bulletin is: Renters, Rent Inflation and Renter Stress (March 2023)

- The Governor’s comments were made by Governor Philip Lowe in an address: Monetary Policy, Demand and Supply (5 April 2023)

We quote from these sources and then add comments.

Why are residential rents increasing?

RBA Bulletin:

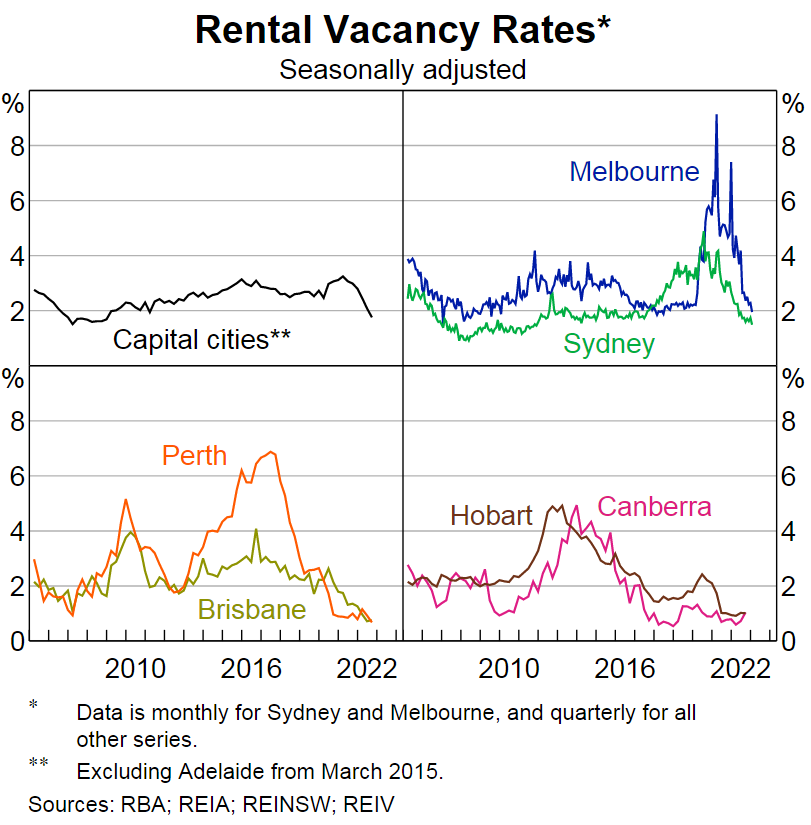

Rental vacancy rates have declined across Australia over the past few years, after increasing early in the pandemic, especially in Sydney and Melbourne.

Comment:

According to a 2019 RBA study, the vacancy rate is the dominant influence on rents:

- When the vacancy rate is 2.4 per cent, rents are steady.

- When the vacancy rate is higher, rents decline.

- When the vacancy rate is lower, rents rise.

The rental vacancy rate has fallen below 2.4 per cent, causing rents to rise.

This graph from the RBA Bulletin shows that vacancy rates were high during the pandemic, but have now fallen below 2 per cent in all capital cities:

Reasons for the current low vacancy rate

RBA Bulletin:

Demand and supply have contributed to strong rises in rents:

- Strong demand – A decline in average household size since the start of the pandemic of 1 per cent resulted in around 120,000 additional households being formed. Through 2020 and 2021, rental increases were stronger in regional areas than in most capital cities, but since the start of 2022, relative demand may have shifted back towards capital cities where advertised rents growth is 10 per cent higher. In addition, the reopening of the international border in early 2022 has contributed to declines in vacancy rates. Around 240,000 people migrating creates demand for an additional 96,000 properties.

- Slowing supply – After strong growth in the mid-2010s, growth in supply of new rentals available to the market is expected to be subdued over the next few years. Despite the demand from immigration and rising rents, higher interest rates and construction costs, combined with declining housing prices and apartment presales, are headwinds to the growth in the supply of new dwellings.

Comment:

As to demand, occupancy will increase - renting out the spare bedroom which was used as a study during the pandemic may slow demand, but the return to the cities and international migration will create strong demand for more housing.

As to supply, developers won’t build new dwellings until prices rise to a level that makes it profitable to build, keeping in mind that building costs have risen by 20% or more during the pandemic and property prices have fallen up to 10%. Cost and availability of construction finance is also a factor.

How long will it take for housing supply to catch up to demand?

RBA Governor:

Population growth has picked up sharply since the pandemic ended and it now seems likely that the annual rate of population growth will soon be around 2 per cent.

In contrast, the expansion in the supply side of the housing market is expected to be fairly modest.

It takes a long time for housing supply to respond fully to shifts in population growth – in the previous episode of population growth (during the resources boom), it took around five years. It is likely that the balance between demand and supply in the housing market will result in rents being quite high for a while.

Comment:

It could be five years until supply catches up with demand for housing.

Will rents continue to rise?

RBA Bulletin:

Over the past decade, rents have grown modestly. Rent inflation across the capital cities has increased by an average rate of 1.1 per cent per year since 2012. The exceptions were Hobart where rents increased strongly, and Perth and Darwin where they declined.

This slow growth in rents has been outpaced by growth in wages (which rose by 2.3 per cent per annum) and household disposable income (which rose by 4.3 per cent per annum), and all groups CPI (which rose by 2.4 per cent per annum).

Comment:

Until recently, rents have been slow to increase. It took 10 years for rent of $400 per week in 2012 to rise by $46 to be $446 per week in 2022, at a rate of 1.1 per cent per annum.

Rents have lagged increases in wages and household disposable income.

Had rents increased over 10 years by growth in wages at a rate of 2.3 per cent per annum, rents would have increased by $102 to be $502 per week. And had rents increased by 4.3 per cent according to household disposable income, they would have increased by $209 to be $609 per week- a 50 per cent increase.

Can renters afford more rent increases?

RBA Bulletin:

The increase in housing costs (rents) has been broadly offset by strong income growth. Part of this growth may reflect lifecycle factors, especially if young renters experience strong income growth as they move up the job ladder or move to higher paying jobs.

Comment:

According to the RBA, young renters with good incomes can afford a rent increase of $163 per week higher than the actual rent they were paying at the start of 2022. This is less than the increase of $240 per week payable by home owners on a home loan of $500,000, from the pandemic payment lows.

As a result, it is cheaper to rent than to buy almost everywhere in Australia. But for how much longer?

If rents rise another $80 to match rises in home loan repayments, this may no longer be the case, and renters may become buyers.

Are home loan interest rates peaking?

RBA Governor:

Since May last year, interest rates have been increased by 3½ percentage points. This is a large increase over a short period and it has been difficult for many people. The first increases were necessary to withdraw the support provided during the pandemic. And then the more recent increases have been required to move monetary policy into restrictive territory to combat the highest rate of inflation experienced in Australia in more than 30 years.

Our current forecast is that inflation returns to the top of the target range (i.e. 3%) but only by mid-2025. Supply-side factors are influencing how fast inflation declines.

Comment:

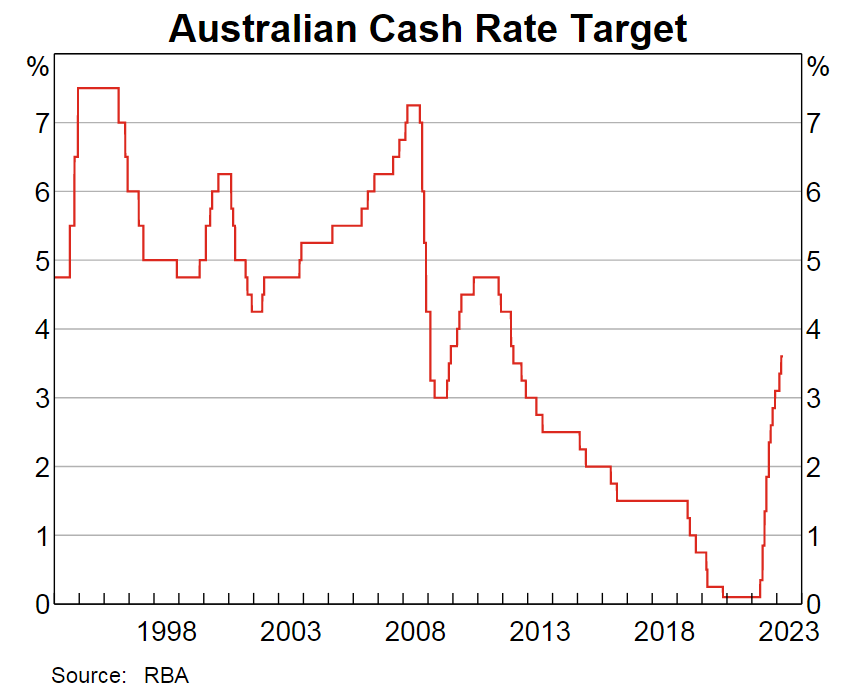

The RBA Cash Rate is in ‘restrictive territory’ which means that is scope to fall once inflation declines (see graph). Home loan interest rates may go a little higher, but they will fall.

According to the Reserve Ban, supply-side issues which influence declines in inflation are the supply in the housing market which influences rent growth (rents make up 6 percent of CPI), the supply of new renewable supply capacity in the electricity market which influences electricity prices and the rate of productivity growth which influences wages.

Comment: The Reserve Bank has been careful not to specify an interest rate which marks the cut-off point between accommodative and restrictive interest rate ‘territory. On 8 March 2023, in an address, Governor Philip Lowe said: “Our assessment is that the more recent rate increases have moved monetary policy into restrictive territory”. Note the word “increases”.

Concluding comments

- Low rental vacancy rates indicate that rents will continue to rise over the next five years

- Interest rates will fall once the Reserve Bank the indications are clear that inflation returning to or at 3 per cent per annum

The indications are that this is a good time to buy a home or a residential investment property.

Cordato Partners - Anthony J Cordato

Sourced from www.lexology.com