30th September 2021

Four Southeast LGAs, Townsville and Palm Island to enter Stage 2 restrictions at 4pm

|

|

|

Four Local Government Areas in Southeast Queensland along with Townsville and Palm Island will enter stage 2 restrictions from 4pm today.

The affected LGAs are Brisbane, Gold Coast, Logan, Moreton Bay, Townsville and Palm Island.

Stage 2 restrictions mean the number of people allowed in a home and in public is reduced to 30, including visitors, residents, and children.

Weddings and funeral will be capped at 100 attendees. A maximum of 20 people will be allowed to dance at weddings.

Restaurants and cafes will return to 1 person per 4sqm and dancing will be banned at venues.

Capacity at sporting events will decrease to 75 per cent, including Sunday’s NRL Grand Final at Suncorp Stadium.

It also means visitors will be restricted at hospitals and aged care, disability services and corrections facilities.

And enhanced mask wearing is required in the LGAs of concern.

Premier Annastacia Palaszczuk said stage 2 restrictions were needed in response to the new cases, including a man who has been active in the Townsville community while infectious.

“The next 24-48 hours is absolutely crucial,” the Premier said.

“I’m asking all Queenslanders to check the list of locations, follow the health advice, and please come forward for testing if you have any symptoms at all.

“And keep doing the things you know how to do so well – wear your masks, check in at venues, wash your hands, socially distance, and stay home if you’re sick.

“Above all, get vaccinated.

“Getting vaccinated will help protect you and your loved ones, and reduce the risk of spread in the community.”

All Queensland Health community vaccination centres will from now on accept walk-ins, with no bookings required.

Minister for Health Yvette D’Ath urged Queenslanders to take the restrictions seriously.

“These restrictions will slow down movement in the community and help our contact tracers by giving them time to work through these new cases,” the Minister said.

“The Chief Health Officer is confident that a lockdown isn’t needed right now, but that can all change quickly.

“I know Queenslanders will do what needs to be done to try and stop this from escalating, so I want to encourage people to keep safe by following the rules.

“Between them, New South Wales and Victoria are seeing thousands of cases a day – we can prevent this in Queensland if people abide by the health directives.”

Chief Health Officer Dr Jeannette Young said there were currently 22 active cases in Queensland.

“Our contact tracers are doing a brilliant job of tracking where these cases have been in the community.

“They work around the clock to achieve the best possible outcome for all Queenslanders and they will continue to do so for these additional cases.

“There is a raft of processes that occur during contact tracing, and it’s not quick or simple. Locations go up as soon as they have gone through all of the checks and balances.

“I would ask all Queenslanders to regularly monitor the list of exposure venues on the Queensland Health website.”

The roadmap with stage 2 restrictions can be found at the Covid-19 website

Email sent to Industry Mailing list 10.26am

Good morning, regrettably as you may be aware, the Queensland Premier is placing Townsville and Palm Island into stage 2 Covid restrictions.

The Government website is yet to be updated given this announcement at the 10am press conference. For now I have provided below what Stage 2 restrictions are from the Queensland Government website.

Real Estate Excellence Members, we are here to support you if we can be of any further assistance and can provide any best practice support.

For more updates and information, visit Restrictions in Queensland | Health and wellbeing | Queensland Government (www.qld.gov.au)

Best wishes.

Stage 2

Movement and gatherings

- Up to 30 people in homes (including those who live there) and public spaces.

- Weddings: Up to 100 people. Max. 20 people can dance.

- Funerals: Up to 100 people.

- Businesses and venues: (including places of worship, convention centres, retail, dining, gyms, hairdressers, beauty and personal care services etc.) Allowed to operate with the following restrictions:

- Indoor – 1 person per 4m2 or 75% capacity with ticketed and allocated seating

- Smaller venues up to 200m2 – 1 person per 2m2, up to a maximum of 50

- Outdoor – 1 person per 2m2

- Eating and drinking must be seated

- No dancing except at weddings.

Stadiums and indoor and outdoor events

- 75% allocated seated and ticketed for stadiums

- Patrons must wear a mask at all times, including when seated.

- Patrons must be seated to eat and drink. Masks can be removed when eating or drinking.

- 75% allocated seated and ticketed capacity for indoor events and outdoor events or 1 per 4m2 indoors and 1 person per 2m2 outdoors.

- Community sport: Can recommence in full including training, competition and school sport, spectators in line with stadiums and indoor and outdoor event requirements.

Masks

You must carry a face mask with you at all times when you leave home, unless you have a lawful reason not to.

- Public Transport and ride share: must wear a mask including while waiting for the transport in a public space such as a bus stop, taxi rank or train station.

- Outdoors: you must wear a mask when unable to stay 1.5m apart from people who are not part of your household.

- Indoors: you must wear a mask in indoor spaces (including workplaces, but not your own home) unless it is unsafe or you can stay 1.5m apart from other people.

- Schools: Masks must be worn by teachers and staff (all schools), plus students in high school.

Masks must be worn when at stadiums, at an airport, and on a domestic or international flight departing or arriving in Queensland.

Kind regards

Stacey Holt

|

| |

|

21st September 2021

RP Data goes down in copyright breach of real estate agency marketing pics

A professional photographer has succeeded in a copyright breach case against Australia’s largest property data and analysis firm for its unauthorised use of marketing pics he supplied to real estate agents for property marketing campaigns.

James Hardingham, sole director of Real Estate Marketing Australia Pty Ltd (REMA) is in the business of providing pictures, graphics and floor plan images to real estate agents for use in marketing campaigns for the sale or lease of properties.

In accordance with oral instructions from real-estate agencies, Hardingham provided his photos and floor plans in an “editable digital form” and payment was made by the agencies on REMA’s invoices.

His clients used the images he supplied in their marketing campaigns for various properties and in course of those campaigns, the images were uploaded to realestate.com.au operated by Realestate.com.au Pty Ltd (REA).

To list a property on REA platform, agencies must enter into a “subscription agreement” and agree to Standards Terms and Conditions including the “grant of an irrevocable, perpetual, world‑wide, royalty free licence to publish, copy, licence to other persons, use and adapt for any purpose, any content provided to REA”.

Agencies were required to warrant that the content they uploaded to REA’s platform did not infringe the intellectual property rights of third parties.

REA in turn provides RP Data Pty Ltd (RPD) details of its property listings together with images, from its website. RPD operates its own website, www.corelogic.com.au on which it provides data it collects about all transactions affecting individual properties so its subscribers have access to such historical data and the images etc of property.

As the photos and floor plans he authored were original artistic works, copyright subsists in him under the Copyright Act.

Hardingham – who started his Sydney based business in 2009 – granted an exclusive licence of the copyright in all his works to REMA by way of a deed they entered into in April 2018.

On 28 January 2014, Hardingham sent a ‘demand letter’ to RPD alleging infringement of his copyright in reproducing his images and floor plans on its website and manipulating them by superimposing its e a logo.

RPD’s solicitors denied the allegation in a letter of April 2018 and the matter was left there for the time being with the photographer continuing to supply images to his clients in the same way as before.

In July 2018, Hardingham commenced proceedings against RPD that came before the Federal Court in Sydney in December 2019.

He contended that REMA supplied the images for the limited purpose of marketing the properties and such licence did not extend to use of the images by RPD.

Justice Tom Thawley ordered a separate trial on the issue of liability confined to the photographs Hardingham had supplied to his client agencies in 20 such listings after January 2014 on the RPD website.

He concluded that having been notified by RPD solicitors in April 2014 of the terms REA demanded from those uploading of content to its site – including its right to use them indefinitely for historical data purposes and to sub-licence the images for use by others – he & REMA had “agreed” as a matter of inference from the conduct and “course of dealings” to the REA terms.

Alternatively – he ruled – agreement to such broad usage rights “should be implied into the agreements between the applicants and the agencies in order to give business efficacy” to the arrangement.

Hardingham appealed.

The appeal judges found that the agencies and Hardingham intended the images be uploaded to REA’s website because that was – when viewed objectively – the only way that the agencies could make use of the supplied product.

They were however divided on whether such implied or inferred term allowed REA’s use of the supplied images “on its usual terms and conditions”.

Justice Greenwood took the view that REA’s standard terms were so wide that it enabled it in all practical terms to virtually “expropriate the ownership of the copyright”.

He and Justice Steven Rares concluded that the trial judge had erroneously concluded that Hardingham and REMA – in the absence of evidence that they and the agencies had knowledge of the precise scope of REA’s purported authority – “must” have consented to such broad terms in their client arrangements.

Rather, because it was by no means likely – had they turned their mind to it – the photographer and the agencies “would have agreed” such term, it could not as a matter of law or fact, be implied.

They found that while there was an implied or inferred right in each of the photographer’s agency clients to grant a sub-license to REA, such arrangement should be confined to what a copyright owner might reasonably and objectively have allowed. Such reasonable terms did not include a right in favour of REA to grant a further sub-license to RPD.

Thus RPD’s historical and current use of the images constitute a breach of the rights of the owner of the intellectual property in each image.

Hardingham v RP Data Pty Limited [2021] FCAFC 148 Greenwood, Rares And Jackson JJ, 18 August 2021

Sourced from qldbusinesspropertylawyers.com.au

8th September 2021

Residential property: Which contract of sale is best in Queensland?

03 September 2021 by Amanda Tolson Clifford Gouldson Lawyers

Whether you are selling your first home or your 5th investment property, selling residential property is a big decision and the drafting of the contract requires proper consideration. It is usually the Seller's agent or solicitor who will prepare the contract of sale, therefore the Seller will usually have first preference in determining the form of the contract including which standard conditions will apply. In Queensland, there are two commonly used standard residential sale contracts – REIQ contracts and ADL contracts. Arguably, the REIQ contracts are more commonly used in residential sales however both contracts are considered standard.

So which contract is right for you? The standard terms of each contract vary considerably so it is worthwhile considering each contract's terms and how they may impact your transaction. Below is a summary of a few of the major differences.

|

REIQ |

ADL |

|

Deposit

A deposit is usually required under all residential sale contracts.

|

Under the REIQ contract, the Buyer must pay the Deposit to the Deposit Holder in cash |

The ADL contract allows for the deposit to be paid to the Deposit Holder by Deposit Bond or Bank Guarantee (in a form and on terms acceptable to the Seller). |

|

Finance condition

It is common for most residential sale contracts to be subject to the Buyer obtaining finance approval on terms satisfactory to the Buyer.

|

The REIQ contract is more buyer-friendly in that the Buyer is only required to take "all reasonable steps" to obtain finance approval, and allows the Buyer to terminate the contract if finance cannot be obtained without providing any evidence that Buyer's application has been rejected, or in fact, even applied for. |

The ADL contract contains an express condition that the Buyer must make an application for finance promptly after the Contract Date and if required by the Seller, the Buyer must provide details of compliance with the obligation to make an application and take reasonable steps to obtain approval or written proof of rejection of the Buyer's application. |

|

Building and Pest condition

Under both contracts, if the Buyer chooses to terminate the contract under the Building and Pest condition, the Buyer must provide the Seller with a copy of the unsatisfactory building and pest report/s.

|

Termination of the contract take effect upon the Buyer giving notice to Seller. The Buyer must provide a copy of the unsatisfactory building and pest report/s if requested by the Seller. |

The ADL contract is drafted so that the Buyer's termination of the contract will not take effect until the unsatisfactory building and pest report/s are provided to the Seller. This additional obligation on the Buyer may cause the Buyer to delay in terminating the contract until a formal report has been prepared by the inspector and provided to the Seller.

The ADL contract also specifically states that white ant risk shall not be a valid reason for termination under the building and pest condition, whereas the REIQ contract is silent on this point.

|

|

Insurance

Both contracts state that the property shall be at the Buyer's risk from 5pm on the next business day after the Contract Date.

|

The REIQ contract does not require the Seller to maintain insurance during the contract period (although we usually recommend that Seller's maintain their insurance during the contract period as well). |

The ADL contract contains a specific requirement that while the Seller is in possession of the property, the Seller must maintain a current insurance policy. |

|

Outgoings Adjustments

|

Under the REIQ contract, the date for adjustment of outgoings (including expenses like rates, water usage and rent) is the Settlement Date (unless otherwise agreed), |

The ADL contract states that the date for adjustment of outgoings is the earlier of the Settlement Date or the date the Buyer takes possession of the property. |

|

Suspension of time

|

Under the REIQ contract, suspension of time only operates where a party is unable to perform its settlement obligations because of natural disaster. |

Under the ADL contract, suspension of time will apply to any essential obligations of either party if that party is affected by a natural disaster. |

|

GST Withholding

|

The REIQ contract authorises the Buyer to draw a Bank cheque for the GST withholding amount in favour of Commissioner of Taxation and to deliver that cheque to the Seller at settlement. It is then the Seller who must pay the GST withholding amount to the ATO promptly after settlement. |

The ADL contract on the other hand authorises the Buyer to withhold the GST withholding amount from the balance purchase price and remit it to the ATO after settlement, i.e. the Buyer is not obliged to provide a bank cheque for the GST withholding amount to the Seller at settlement. |

Conclusion

On the balance, the ADL contract terms make it harder for a buyer to terminate the contract under standard conditions like finance or building and pest however they also impose a number of additional obligations on the seller that the REIQ contract does not. Before you enter into any contract for the sale of your residential property we strongly suggest you speak with one of our property lawyers to ensure the best contract is used for your unique circumstances.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

AUTHOR(S) Amanda Tolson Clifford Gouldson Lawyers

Source www.mondaq.com by Real Estate Excellence

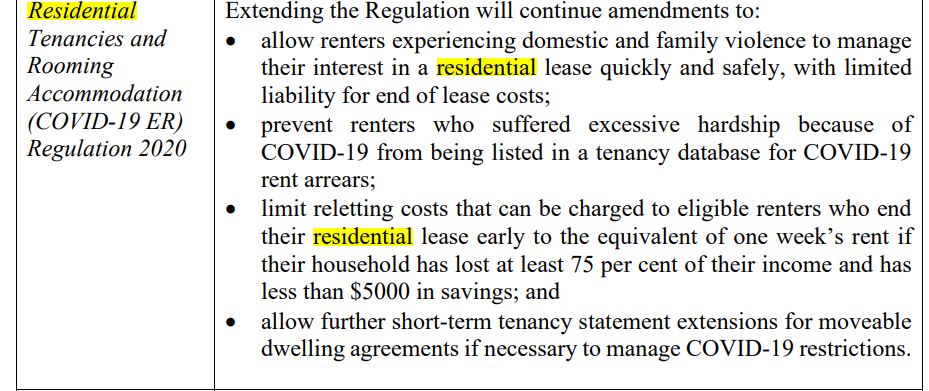

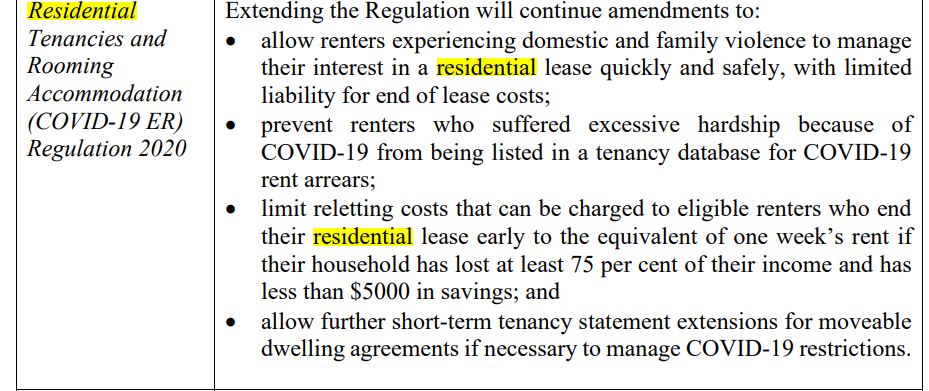

2nd September 2021 - COVID Tenancy laws extended

The Covid Tenancy Regulations end date have been extended. More information including what is still in place will be provided to Members of Real Estate Excellence as part of the September Real Estate Excellence Member Updates.